how much state tax do you pay on a 457 withdrawal

You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. In most circumstances an early.

How Can I Get My 401 K Money Without Paying Taxes

However if you withdraw from your.

. Amount to withdraw. However if you save on the 403b you will receive a 10 penalty on. Use this calculator to see what your net withdrawal would.

Enter an amount between 0 and. When you take 401 k distributions and have the money sent directly to you the service provider is required to withhold 20 for. How much tax do you pay on a 401k withdrawal.

However if you make between 5050 and 10100 Ohio assesses you. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Discover Helpful Information And Resources On Taxes From AARP. For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a. How do 457b plans work.

Ad A Tax Advisor Will Answer You Now. The current state marginal tax rate you expect to pay on any additional income or taxable distributions. 457 Plan Withdrawal Calculator Definitions.

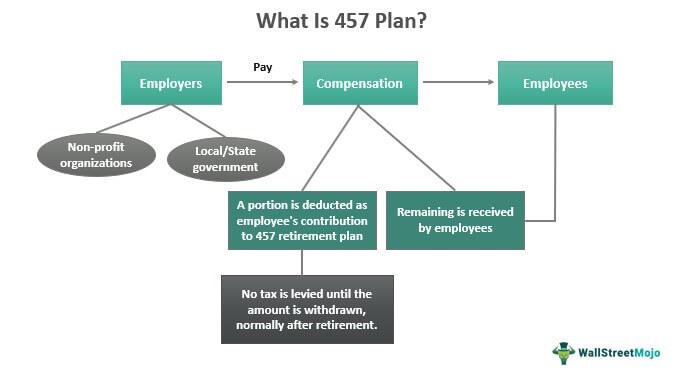

Employers or employees through salary reductions. Ad Find Deals on tax software 2021 federal state in Calendars on Amazon. If you do not wait until the age of 59-12 to withdraw your 401 k funds you may pay a penalty tax in addition to federal state and local taxes.

For example if you fall in the 12 tax. Ad Compare Your 2022 Tax Bracket vs. That way you can at least get valuable credit card rewards.

Questions Answered Every Nine Secs. The organization must be a state or local government or a tax-exempt organization under IRC 501c. If you have a 457b you can withdraw the budget from your account without any early withdrawal penalty.

Basically any amount you withdraw from your 401 k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return. How Withdrawals Work. Your 2021 Tax Bracket To See Whats Been Adjusted.

457 Plan Withdrawal indicates required. Download Avalara sales tax rate tables by state or search tax rates by individual address. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans.

This entry is required. For example your retirement income is taxable at the 0587 percent rate when you make up to 5050 as of 2011. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 ½. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. Press spacebar to hide inputs.

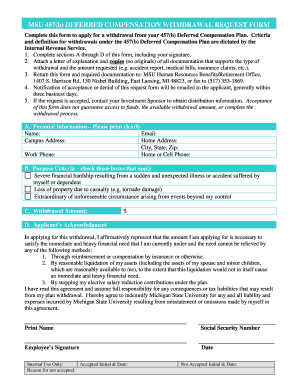

When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. As you pay your tax bill another thing to consider is using a tax-filing service that lets you pay your taxes by credit card. 457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Can you withdraw money from 457b. It increases your income and you pay your ordinary tax rate on the conversion.

What Are Defined Contribution Retirement Plans Tax Policy Center

Is The Tsp A 457 Plan Government Worker Fi

Retirement Plan Withdrawal Clarification Chicago Teachers Union

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

401 K Vs 457 B Tax Deferred Retirement Plans Available To Private Sector Employees And Government Workers

Can You Maximize A 401k 403b And A 457 Wrenne Financial Planning Lexington Ky

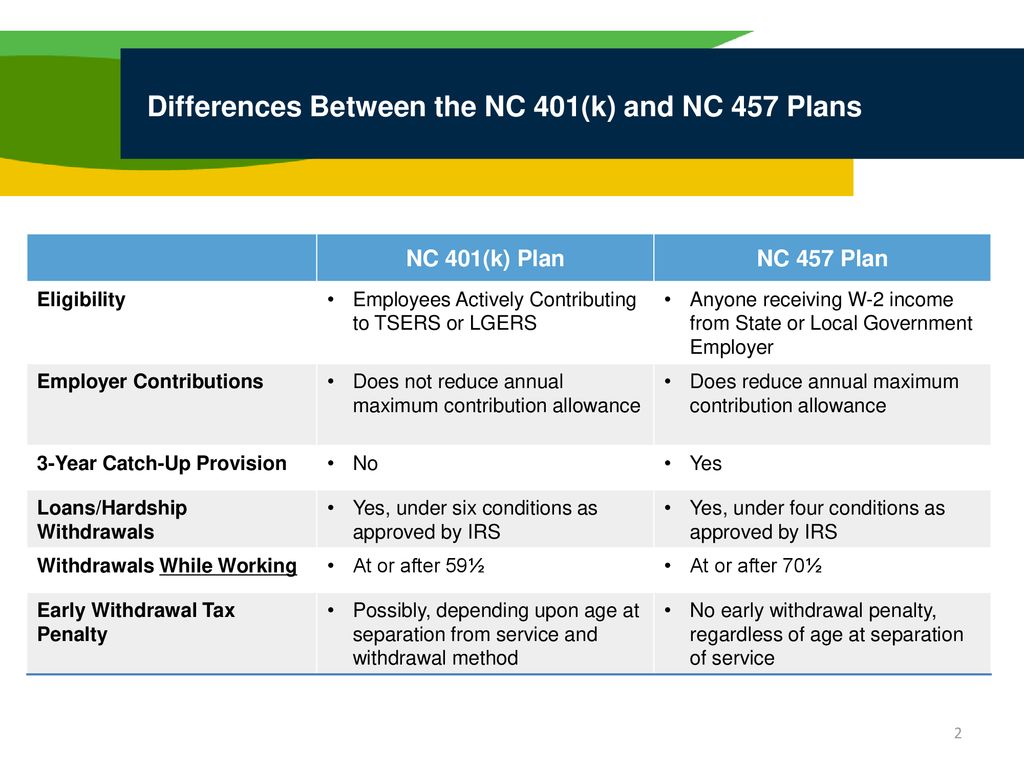

Nc 401 K Nc 457 Retirement Plans Ppt Download

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

Credit Union 457 B Deferred Compensation Plan Rbfcu

Irs Form 1099 R Box 7 Distribution Codes Ascensus

How A 457 Plan Works After Retirement

Taking Money Out In Retirement

:max_bytes(150000):strip_icc()/financial-advisor-having-a-meeting-with-clients-1063753064-d9de431611904a8389e37b04441f4b1c.jpg)

Section 457 Retirement Plan Contribution Limits

How To Access Retirement Funds Early

Fillable Online Hr Msu 457 B Deferred Compensation Plan Withdrawal Request Form Hr Msu Fax Email Print Pdffiller

How Cares Act Eases Retirement Account Rules Forbes Advisor